Stock trading VS Option Trading

Options or Stocks? Where should you put your capital and which one is better for you? Is options trading better than stocks? Stock trading vs Options trading help in finding the differences and in choosing the right format of trading for you.

What is Stock Trading?

To understand the differences between the two formats of trading it is important to first understand their respective meanings.Stock trading is all about buying and selling shares of the company. Here the investor expects profit from the change in stock prices which generally depends upon the business growth. It can be done for a day (intraday) or one can hold shares of the company for a few weeks to months (swing trading).

Since we are comparing stock trading with options, which is a short form of trading, hence it makes more sense to compare swing trading with options trading. The following listed parameters are defined in terms of swing trading.

What is Options Trading?

Now, let’s understand options trading. Options trading is buying and selling a contract where buyers pay a premium to the seller and gain the right but not the obligation to settle the trade at the pre-determined price in the future.

Is Option Trading Better than Stocks?

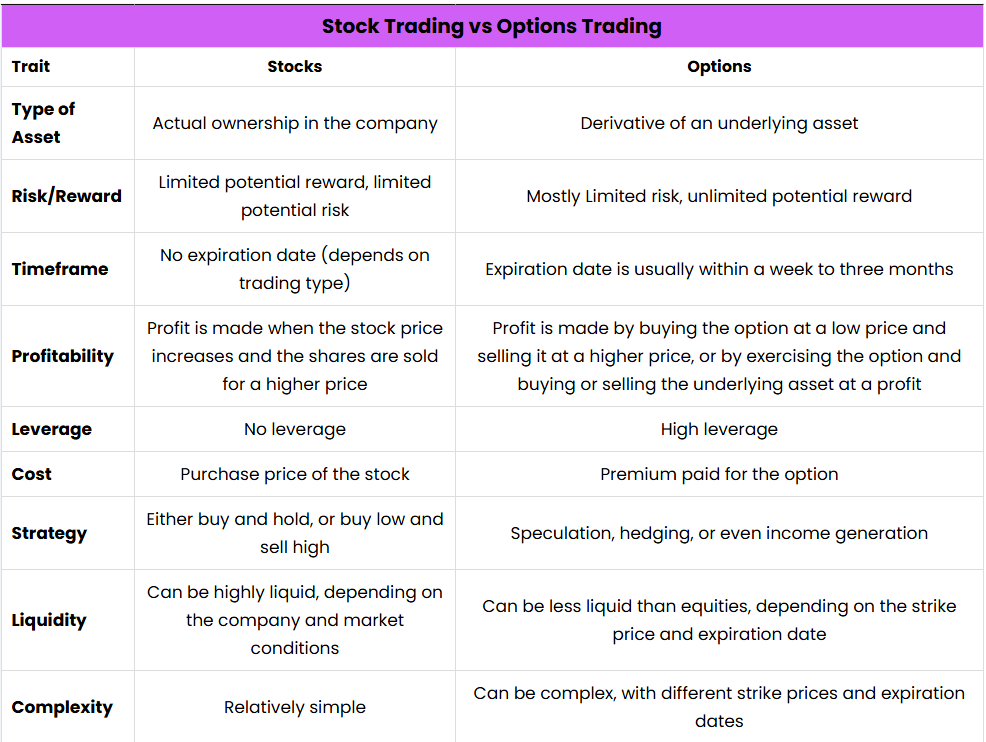

Let’s quickly now compare the different aspects of stock trading vs options trading discussed above. In the table below understand the major differences between the two trading formats and choose the right one to earn good profit in the market.

Example: PAO order and PAE order start an Auction

Also, all the profit earned in options trade is considered as your business income and is calculated using option turnover value.

There are important risks associated with transacting in any of the Share Market products discussed here. Before engaging in any transactions in those products, it is important for market participants to carefully review the disclosures and disclaimers. These products are complex and are suitable only for sophisticated market participants. In certain jurisdictions, We are only guiding to investment professionals, certified sophisticated investors, or high net worth corporations and associations. These products involve the risk of loss, which can be substantial and, depending on the type of product, can exceed the amount of money deposited in establishing the position. Market participants should put at risk only funds that they can afford to lose without affecting their lifestyle. © 2025 AIMARKETTRADE. All Rights Reserved.